Payday loans are a type of short-term fundin quick loans kenyag that can provide quick cash money to people in need of immediate financial assistance. In Pretoria, the capital city of South Africa, payday advance are a prominent option for those dealing with unanticipated costs or cash flow problems. This short article will give an introduction of payday advance loan in Pretoria, including how they work, the advantages and threats connected with them, and the laws that govern the sector.

Exactly How Cash Advance Loans Job

Cash advance are typically small-dollar financings that are indicated to be settled within a brief period of time, usually within 2 to 4 weeks. In Pretoria, customers can obtain a payday advance online or in-person at a payday advance shop. To get approved for a cash advance, debtors have to have a stable source of income and a legitimate savings account.

As soon as approved, customers get the funds in their savings account and agree to settle the finance quantity, plus interest and charges, on their next payday. The repayment quantity is immediately deducted from the debtor’s checking account on the due date, making it a hassle-free and easy loaning option for many people.

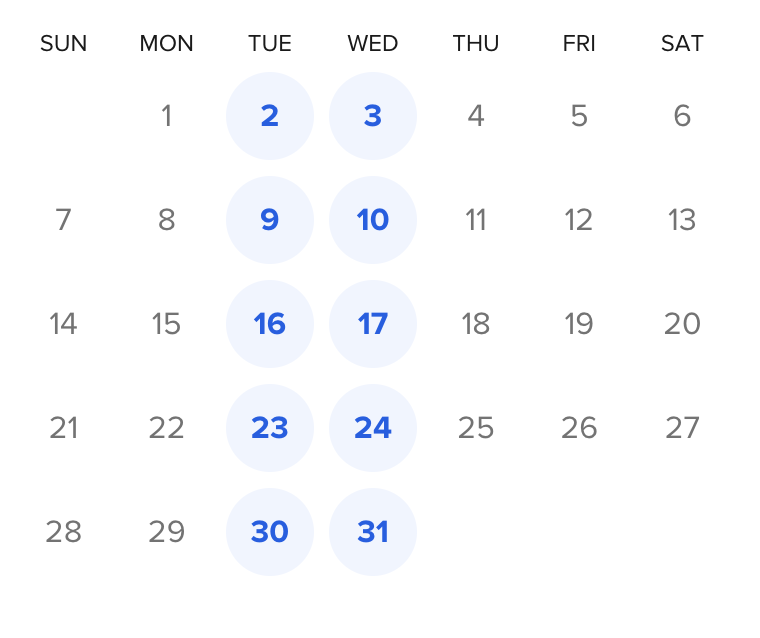

Feeling STUCK with JIRA / Agile ?

Schedule 1-on-1 Session with Anatoly and His Team and Get Instant HELP!!!!

It is essential to note that payday loans in Pretoria are suggested to be a temporary remedy to financial emergencies and should not be utilized as a long-lasting monetary method. Debtors need to meticulously payday loans south africa consider their payment capability prior to securing a payday loan to avoid falling into a cycle of debt.

- Small-dollar car loans suggested to be paid back within a short period of time

- Customers must have a stable income and legitimate savings account

- Settlement amount automatically subtracted from savings account on due day

The Benefits and Risks of Payday Loans

Cash advance in Pretoria use numerous advantages to debtors, consisting of fast access to cash, very little documents requirements, and no debt check. These variables make payday advance loan an appealing choice for people with bad credit score or those who need money quickly.

Nonetheless, payday loans likewise include threats that borrowers need to be aware of. The high rates of interest and fees associated with payday advance can make them a pricey loaning alternative, especially if the car loan is not paid off on time. In addition, some cash advance lending institutions in Pretoria have actually been understood to take part in predatory lending techniques, causing monetary challenge for consumers.

It is essential for borrowers to carefully check out the terms and conditions of a payday advance loan prior to authorizing any kind of arrangements and to only obtain what they can manage to pay off. By recognizing the threats associated with payday loans and making notified choices, consumers can prevent possible economic pitfalls and make use of payday advances sensibly.

Regulations Governing Cash Advance Loans in Pretoria

Payday advance loan in Pretoria are controlled by the National Credit Scores Regulator (NCR), which sets standards for the cash advance financing industry to shield customers from unfair borrowing practices. The NCR needs payday lending institutions to follow stringent policies, consisting of limitations on interest rates and costs, along with openness in lending terms and conditions.

- National Credit History Regulator (NCR) manages payday loans in Pretoria

- Standards readied to secure customers from unjust financing practices

- Rigorous policies on rates of interest, fees, and transparency

Finally

Cash advance in Pretoria can be a practical economic tool for people in need of quick money for emergency situations or unexpected expenditures. Nevertheless, customers ought to understand the advantages and dangers related to cash advance and make informed choices when taking out a lending. By comprehending just how payday advances function, the regulations that regulate the sector, and the relevance of accountable loaning, individuals in Pretoria can use payday loans to their advantage while staying clear of prospective financial mistakes.