Funding applications have changed the way people obtain and provide money. With just a few click your mobile phone, you can access quick money to cover unanticipated expenses or fund your next large purchase. However with numerous options readily available, it can be overwhelming to pick the appropriate loan application for your needs. In this extensive guide, we will certainly break down whatever you require to learn about lending applications.

What are Funding Apps?

Funding apps are mobile applications that allow users to obtain money directly from their mobile phones. These apps give a practical and quick means to access funds without the demand for extensive paperwork or in-person meetings. Individuals can apply for fundings, manage their accounts, and make payments all within the application.

Car loan applications generally offer various sorts of financings, including personal financings, payday loans, installment loans, and a lot more. The terms and conditions of these financings vary depending upon the application and the lender. Some financing applications cater to individuals with inadequate debt, while others may require a great credit rating for authorization.

Feeling STUCK with JIRA / Agile ?

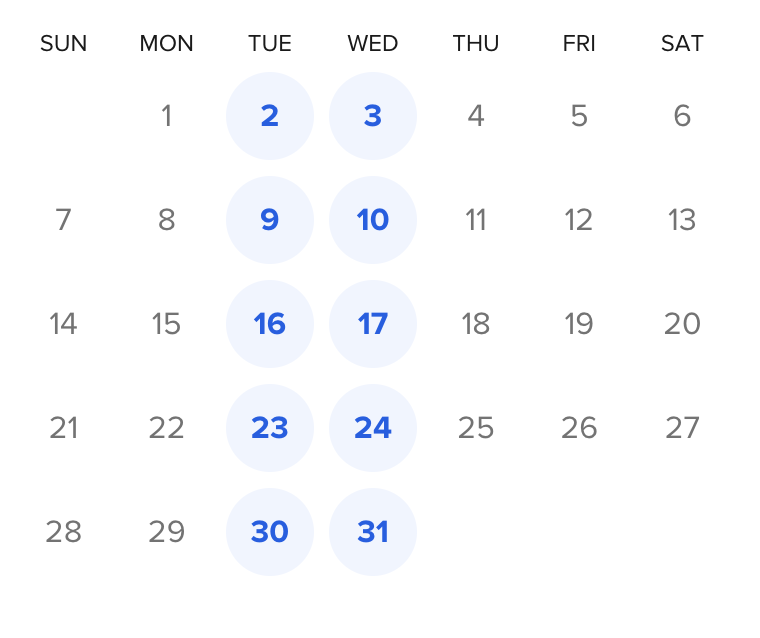

Schedule 1-on-1 Session with Anatoly and His Team and Get Instant HELP!!!!

When using a lending app, it is important to carefully review the terms, consisting of the rate of interest, fees, repayment schedule, and any kind of various other appropriate info. It is essential to obtain properly and just take out a finance if you can manage to repay it.

- Rapid and practical way to borrow money

- Different sorts of financings readily available

- Terms and conditions vary by app and lending institution

- Vital to borrow responsibly

Just how to Pick the Right Car Loan App

With many car loan apps on the market, it can be challenging to identify which one is the most effective fit for your economic requirements. Right here are some elements to think about when choosing a financing application:

1. Rates Of Interest: Compare the interest rates supplied by different lending apps to guarantee you are obtaining the best bargain. Lower rates of interest can save you cash in the long run.

2. Charges: Understand any type of fees associated with the finance, such as origination costs, late repayment fees, or prepayment penalties. These charges can include in the total expense of the financing.

3. Payment Terms: Consider the settlement terms used by the car loan application, including the length of the car loan and the frequency of payments. Select a funding application that provides adaptable payment alternatives that straighten with your spending plan.

Kinds Of Car Loan Apps

There are several kinds of car loan apps available to borrowers, each catering to different monetary requirements. Some typical kinds of lending apps include:

- Personal Financing Applications: These applications offer unsafe personal financings that can be utilized for any kind of objective, such as financial debt combination, home improvements, or clinical expenditures.

- Payday Advance Apps: Cash advance apps supply short-term loans that are normally due on the customer’s following payday. These loans are typically made use of to cover unexpected expenses or emergencies.

- Installation Loan Apps: Installment urgent loan 10,000 app loan apps enable debtors to repay the finance in taken care of monthly installments over a collection duration. These fundings are suitable for bigger expenses that can not be settled in a single repayment.

Benefits of Making Use Of Financing Applications

Lending apps provide a number of advantages to consumers, consisting of:

- Comfort: Get a financing anytime, anywhere from your smart device.

- Rate: Obtain accepted for a lending swiftly and get funds in as low as one service day.

- Ease of access: Consumers with bad credit history might still get a lending via a funding application.

- Transparency: Financing apps provide clear terms, making it easy for customers to understand their commitments.

Conclusion

Finance applications have actually changed the lending sector, making it less complicated than ever for individuals to access funds when they require them. By recognizing exactly how car loan apps job and what to take into consideration when picking one, you can make enlightened decisions regarding obtaining cash. Bear in mind to obtain sensibly and just secure a loan if you can pay for to settle it.